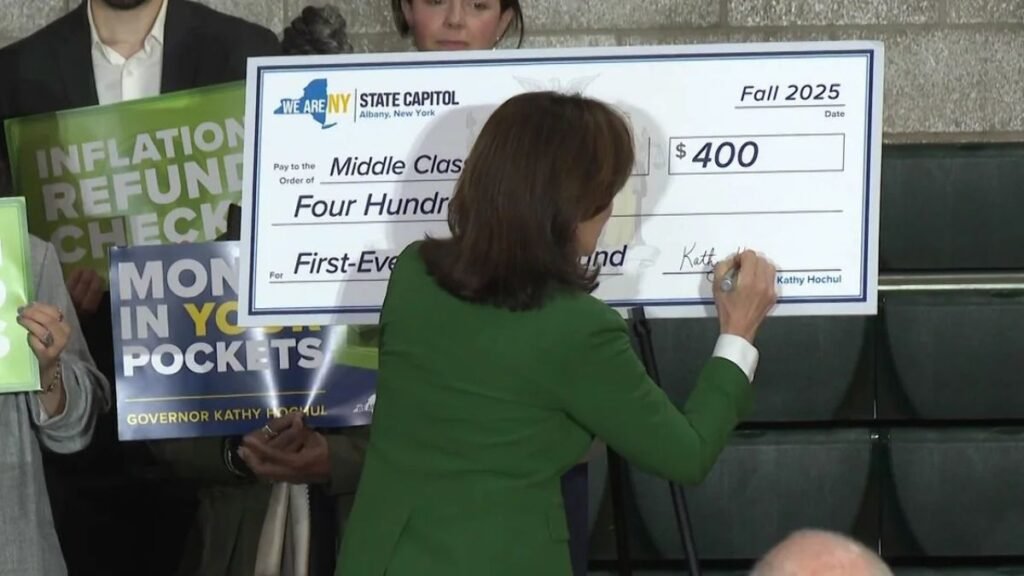

New York State is distributing $400 “inflation refund” checks to eligible residents in October 2025. This initiative was taken by the state government to mitigate the economic pressures caused by inflation and rising living costs. Governor Kathy Hochul announced the plan, stating that the amount is being returned directly to taxpayers from the state’s surplus revenue. An estimated 8.2 million households will benefit from this payment plan.

The plan aims not only to provide financial relief but also to stimulate the state’s economy and increase people’s purchasing power. The distribution process began in late September 2025 and will continue through October and November.

Eligibility: $400 Inflation Refund Check

The eligibility process for receiving a $400 inflation refund check is simple, but certain requirements must be met.

Tax Filing Status

This payment requires that the individual have filed a New York State Resident Income Tax Return for the 2023 tax year. This includes Form IT-201, the standard tax form for individual taxpayers in New York State.

Income Limits and Payment Amount

The payment amount depends on income limits and tax filing status. The following table clearly outlines the payment amount and eligibility:

| Filing Status | Income Limit | Refund Amount |

|---|---|---|

| Single Filers | $75,000 or less | $200 |

| Single Filers | $75,001 – $150,000 | $150 |

| Married Filing Jointly | $150,000 or less | $400 |

| Married Filing Jointly | $150,001 – $300,000 | $300 |

| Head of Household | $75,000 or less | $200 |

| Head of Household | $75,001 – $150,000 | $150 |

| Qualifying Surviving Spouse | $150,000 or less | $400 |

| Qualifying Surviving Spouse | $150,001 – $300,000 | $300 |

Other Key Eligibility Conditions

- Dependents: If you are declared a dependent by someone else, you are not eligible.

- Tax Return Filing: Those who did not file a tax return in 2023 or were not required to file are not eligible for the payment.

- Timely Address Verification: Checks will be sent to the correct address, so it’s important to ensure the correct address is entered on your 2023 tax return.

Delivery Timeline: When will you receive the payment?

The process of distributing $400 inflation refund checks is massive, with over 8 million checks to be sent. The distribution process is as follows:

- End of September 2025: Distribution begins.

- October 2025: Most checks will be distributed.

- End of November 2025: Final checks will be distributed.

Checks will be mailed directly to residents’ addresses. No applications or additional documentation are required. Delivery will be via USPS, so checks may arrive late in some areas.

Scam and Fraud Prevention

Even though this payment provides financial relief, New York residents should be wary of potential fraud.

Signs of Fraud

- Demand for Social Security numbers, bank accounts, or credit card details via email, phone call, or text.

- Any unsolicited message claiming to be from the New York State Department of Taxation and Finance.

Security Measures

- Verify through official channels. Do not share information with an unknown source.

- The Department will never send unsolicited messages asking for sensitive personal information.

Impact on the Local Economy

The $400 payments to more than 8 million residents will have an immediate impact on New York’s economy.

- Increased Consumption: This amount will encourage more spending in local businesses, especially in the retail, service, and transportation sectors.

- Household Relief: Families facing inflationary pressures will receive temporary financial relief.

- Combating Inflation: According to recent data, the cost of living has increased 5.4% in the past year, with food prices rising 10.2% and gasoline prices rising 18.7%.

Low-income families have been hardest hit by this increased inflation. This payment will provide some stability to their financial situation and make it easier to manage daily expenses.

Impact and Use of the $400 Payment

This payment can help cover the following expenses:

- Grocery items: Daily food and essential items.

- Petrol/Gas: For travel and daily commutes.

- Utilities: Electricity, water, and gas bills.

- Healthcare: Medicines, doctor’s fees, etc.

- Childcare: School- or daycare-related expenses.

Although $400 isn’t a long-term solution, it provides financial stability for a few months. Some families could also use it to repay existing debt or cover monthly expenses.

Conclusion

New York State’s $400 Inflation Refund Check Program is an important step toward alleviating the economic pressures caused by inflation and the cost of living. This program not only provides immediate financial relief to residents but also helps keep the local economy active.

Residents are advised to keep their tax return information updated, pay attention to receipt of checks, and be wary of any suspicious messages or calls.

This program will provide temporary but immediate financial relief to millions of residents, making their lives a little easier and more manageable.

FAQs

Q. Who is eligible for the $400 inflation refund?

A. Eligible residents must have filed a New York State income tax return for 2023 and meet the income limits.

Q. Do I need to apply to receive the refund?

A. No, the payment will be mailed automatically to the address on your most recent tax return.

Q. When will I receive my $400 check?

A. Checks are being mailed from late September 2025, with most arriving in October and the final batch by November.

Q. How is the refund amount determined?

A. The amount depends on your filing status and income, ranging from $150–$400.

Q. Will receiving this refund affect my other benefits?

A. No, the inflation refund does not impact other benefits or tax credits.